“Before the hour, it’s not the hour.

After the hour, go back to another life.”

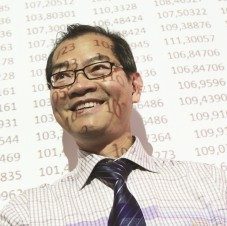

Duc PHAM-HI

Head of the Fintech & Macroeconomics Major

Fintech & Macroeconomics major

Anticipating future professions in the financial sector

- Duration : 2 years

- Start date: September

- Campus: Paris

- ECTS credits : 120

- Language of instruction: French

- Rhythm: Initial

Presentation of the Fintech & Macroeconomics Major

New technologies such as Distributed Ledgers (“blockchain”), Automated Learning (“A.I.”), and Quantum Computing have already begun to create disruptive transformations (replacing human jobs, accelerating financial rhythms, breaching traditional security…).

The corporate world and the mentality of consumers are changing in line with macroeconomic trends and laws that are very powerful but still very diffuse. The Fintech and Macroeconomics specialization trains engineers to handle the concepts and formulations of the laws of Finance, governing all the players in these worlds of the immediate future.

Objectives of the Fintech & Macroeconomics engineering major

Mastering the benefits and dangers of life through mathematical approaches

Tame the maths with numerical analysis and stochastic simulation techniques

Transforming fears into processable multidimensional models

Learn to frame risks using quantitative and analytical thinking

Career opportunities for the Fintech & Macroeconomics Major

- Quantitative economist

- Applied macroeconomist

- Macro-financial strategies analyst

- Econophysics researcher

- Dynamic financial systems modeler

- Prospective analyst / macro-economic scenarios

- Consultant in economic and financial strategies

- Analyst for Think Tank

- Expert in economic public policy

- Research engineer in advanced financial modeling

Major Manager -Duc Pham-Hi

Classes préparatoires Louis Le Grand ; Centrale Paris (class of 80) ; Licence Sciences économiques Paris-Sorbonne (79) ; Sciences Po Paris (class of 81), Doctoral thesis at CNRS (Hamilton-Jacobi equations,1985)

Executive Assistant at the Banque de France, in charge of AI applied to SME diagnostics; Responsible for the transition to Client-Server Architecture for the 1,200 branches of the Victoire Assurances Group; Head of Department at Crédit National; Proprietary trader on neural networks, and R&D Director at Natexis Banque; Director of Global Risk Management Solutions at PricewaterhouseCoopers; Basel II Project Manager at the French Banking Commission (ACPR).

Professeur associé école Centrale Paris ; Maitre de Conférences Sciences Po Paris (1983-1988) ; Visiting professor Aalborg University (Denmark 2014) Visiting professor Kyung Pook National University (South Korea 2015)