“If it’s simple, it’s wrong.

If it’s complicated, it’s unusable.”

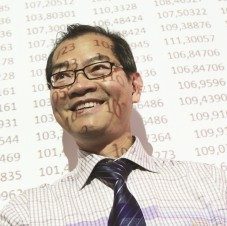

Duc PHAM-HI

Head of the Corporate Finance major

Corporate Finance major

Anticipating future professions in the financial sector

- Duration : 2 years

- Start date: September

- Campus: Paris

- ECTS credits : 120

- Language of instruction: French

- Rhythm: Initial

Presentation of the Corporate Finance major

In Corporate Finance, mathematics is used to calculate the numerical optimization of individual situations of companies, large or small, leading to the maximization of their profits, synergies in M&A (mergers and acquisitions),

the best integration of two or more merging entities (application to Mergers & Acquisitions, Takeovers, Exchange Offers, etc.), the minimization of their risks (application to regulatory banking risk models), their costs or losses, their taxation (application to Tax Consulting).

Objectives of the Corporate Finance major engineering cycle

Mastering the benefits and dangers of life through mathematical approaches

Tame the maths with numerical analysis and stochastic simulation techniques

Transforming fears into processable multidimensional models

Learn to frame risks using quantitative and analytical thinking

Career opportunities for the Corporate Finance major

- Financial audit consultant

- Financial consulting

- Securitization Consultant

- Tax optimization consultant

- Business Engineer ESN Banking & Finance

- Organizer of structuring activities

- HR engineer / recruitment in Finance-Banking

- Wealth Manager

- Specialized credit analyst

- Portfolio Manager

Major Manager -Duc Pham-Hi

Classes préparatoires Louis Le Grand ; Centrale Paris (class of 80) ; Licence Sciences économiques Paris-Sorbonne (79) ; Sciences Po Paris (class of 81), Doctoral thesis at CNRS (Hamilton-Jacobi equations,1985)

Executive Assistant at the Banque de France, in charge of AI applied to SME diagnostics; Responsible for the transition to Client-Server Architecture for the 1,200 branches of the Victoire Assurances Group; Head of Department at Crédit National; Proprietary trader on neural networks, and R&D Director at Natexis Banque; Director of Global Risk Management Solutions at PricewaterhouseCoopers; Basel II Project Manager at the French Banking Commission (ACPR).

Professeur associé école Centrale Paris ; Maitre de Conférences Sciences Po Paris (1983-1988) ; Visiting professor Aalborg University (Denmark 2014) Visiting professor Kyung Pook National University (South Korea 2015)